A number of global investors have Anticipationelected not to participate in Ant Group’s share buyback scheme as the Chinese fintech giant’s valuation slumped more than 70% prior to its planned IPO, Bloomberg reported on Tuesday. Canada Pension, Singaporean sovereign wealth fund GIC, and US-based fund Carlyle Group are among the investors that have exited Ant’s stake repurchase plan, according to Bloomberg. Chinese authorities halted what would have been a record-setting $37 billion public listing for Ant in 2020, with the Jack Ma-founded company’s valuation having since crashed. Ant last month made an offer to buy back as much as 7.6% of its shares at a price that values the firm at about $79 billion. Alibaba has said it won’t sell any shares to Ant Group. [Bloomberg]

(Editor: {typename type="name"/})

Wordle today: The answer and hints for January 28, 2025

Wordle today: The answer and hints for January 28, 2025

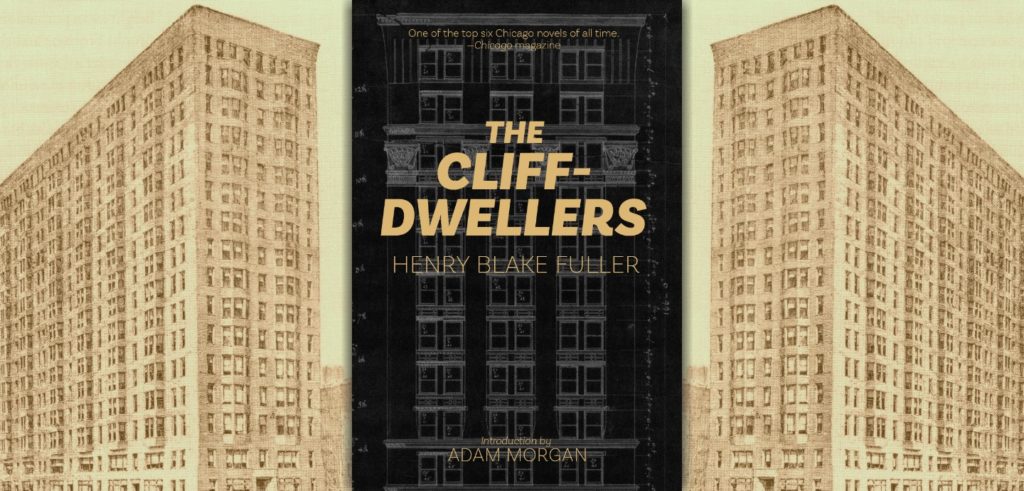

Is This a Classic Chicago Novel?

Is This a Classic Chicago Novel?

Staff Picks: Trick Mirrors, Summer Beers, and Bedazzled Pianos by The Paris Review

Staff Picks: Trick Mirrors, Summer Beers, and Bedazzled Pianos by The Paris Review

Witches, Artists, and Pandemonium in ‘Hereditary’

Witches, Artists, and Pandemonium in ‘Hereditary’

Meta says some AGI systems are too risky to release

Since AI came into our world, creators have put a lead foot down on the gas. However, according to a

...[Details]

Since AI came into our world, creators have put a lead foot down on the gas. However, according to a

...[Details]

A Life of Reading Is Never Lonely

A Life of Reading Is Never LonelyBy Edmund WhiteJune 26, 2018Arts & CulturePhoto by Nadja Spiege

...[Details]

A Life of Reading Is Never LonelyBy Edmund WhiteJune 26, 2018Arts & CulturePhoto by Nadja Spiege

...[Details]

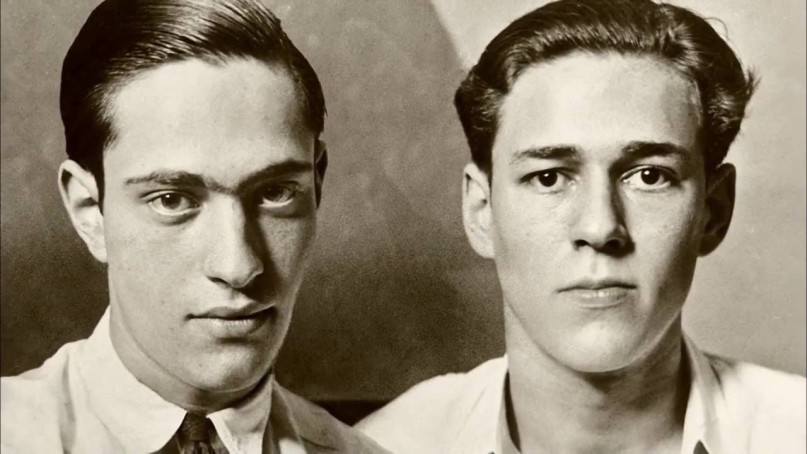

Reopening the Case Files of Leopold and Loeb

Reopening the Case Files of Leopold and LoebBy Jeremy LybargerJuly 26, 2018Arts & CultureNathan

...[Details]

Reopening the Case Files of Leopold and LoebBy Jeremy LybargerJuly 26, 2018Arts & CultureNathan

...[Details]

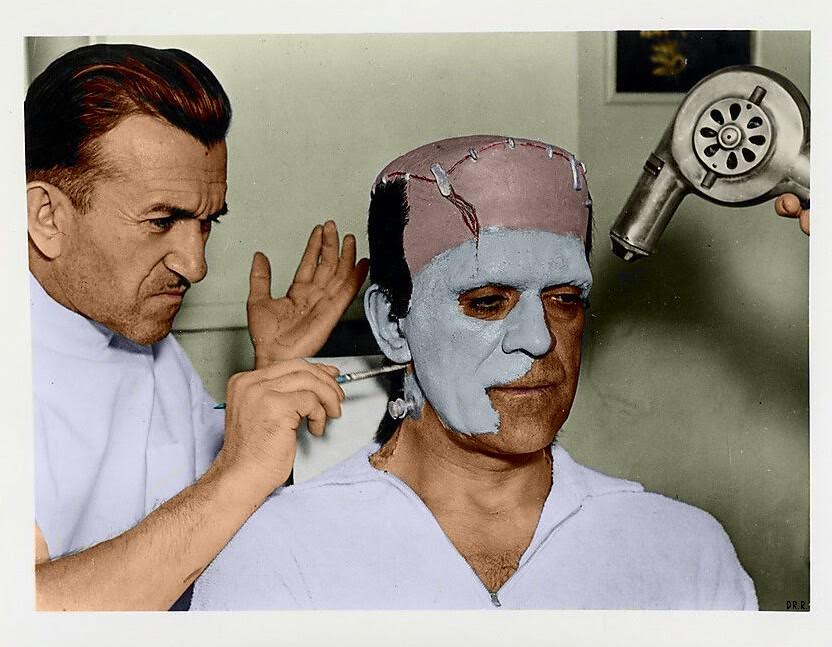

On ‘Frankenstein,’ A Monster of a Book

On Frankenstein, A Monster of a BookBy Hernan DiazJune 19, 2018Arts & CultureBehind the scenes o

...[Details]

On Frankenstein, A Monster of a BookBy Hernan DiazJune 19, 2018Arts & CultureBehind the scenes o

...[Details]

Apple's newest ad makes a haunting plea to take climate change seriously

Apple's latest commercial is advertising the Earth.In a rare topical turn for the company, the ad ma

...[Details]

Apple's latest commercial is advertising the Earth.In a rare topical turn for the company, the ad ma

...[Details]

Redux: On Trial by The Paris Review

Redux: On TrialBy The Paris ReviewJuly 31, 2018ReduxEvery week, the editors of The Paris Review lift

...[Details]

Redux: On TrialBy The Paris ReviewJuly 31, 2018ReduxEvery week, the editors of The Paris Review lift

...[Details]

The Melancholy of the Hedgehog

The Melancholy of the HedgehogBy Aysegul SavasJuly 20, 2018Arts & CultureOn the sweet sadness of

...[Details]

The Melancholy of the HedgehogBy Aysegul SavasJuly 20, 2018Arts & CultureOn the sweet sadness of

...[Details]

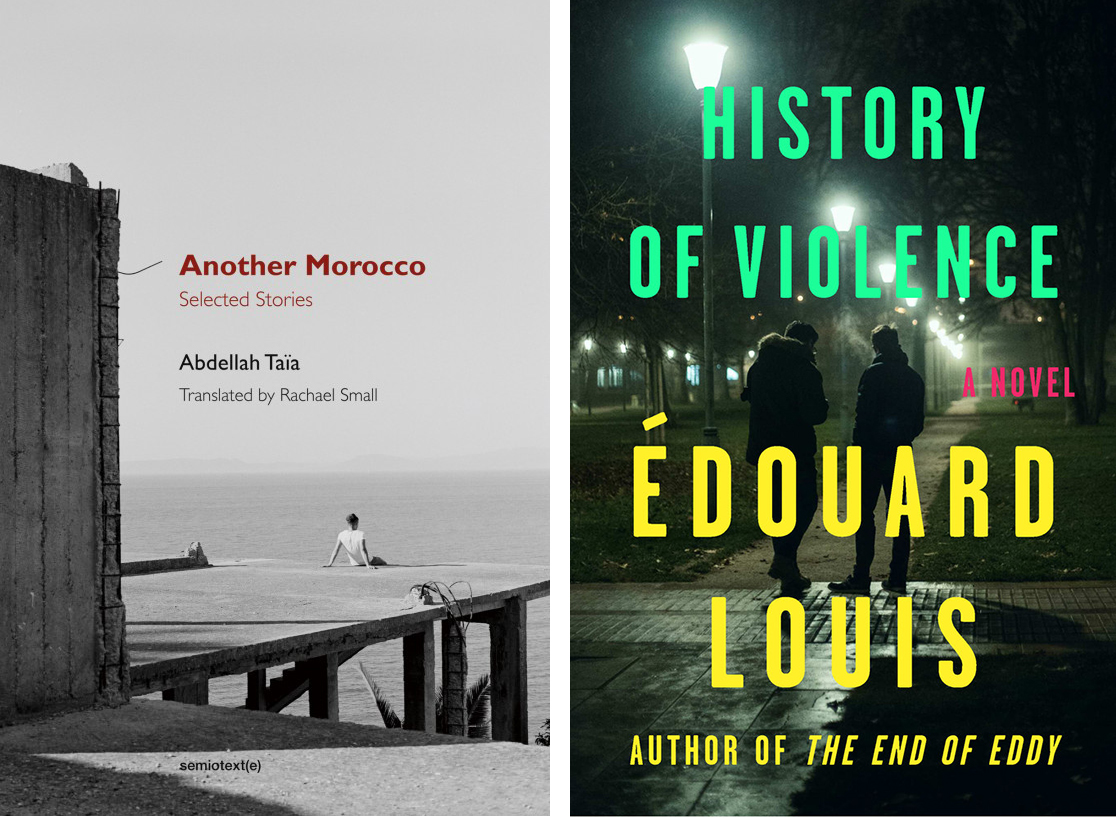

Edouard Louis and Abdellah Taïa in Conversation

We Speak About Violence: Abdellah Taïa and Edouard Louis in ConversationBy The Paris ReviewJuly 2, 2

...[Details]

We Speak About Violence: Abdellah Taïa and Edouard Louis in ConversationBy The Paris ReviewJuly 2, 2

...[Details]

Trump who? Tech giants join massive effort to uphold Paris Agreement

U.S. tech titans are joining an effort by more than 1,000 U.S. governors, mayors, investors, univers

...[Details]

U.S. tech titans are joining an effort by more than 1,000 U.S. governors, mayors, investors, univers

...[Details]

Donald Hall, Who Gave His Life to Work and Eros

Donald Hall, Who Gave His Life to Work and ErosBy Henri ColeJune 25, 2018In MemoriamDonald Hall in 2

...[Details]

Donald Hall, Who Gave His Life to Work and ErosBy Henri ColeJune 25, 2018In MemoriamDonald Hall in 2

...[Details]

Golden State Warriors vs. Los Angeles Lakers 2025 livestream: Watch NBA online

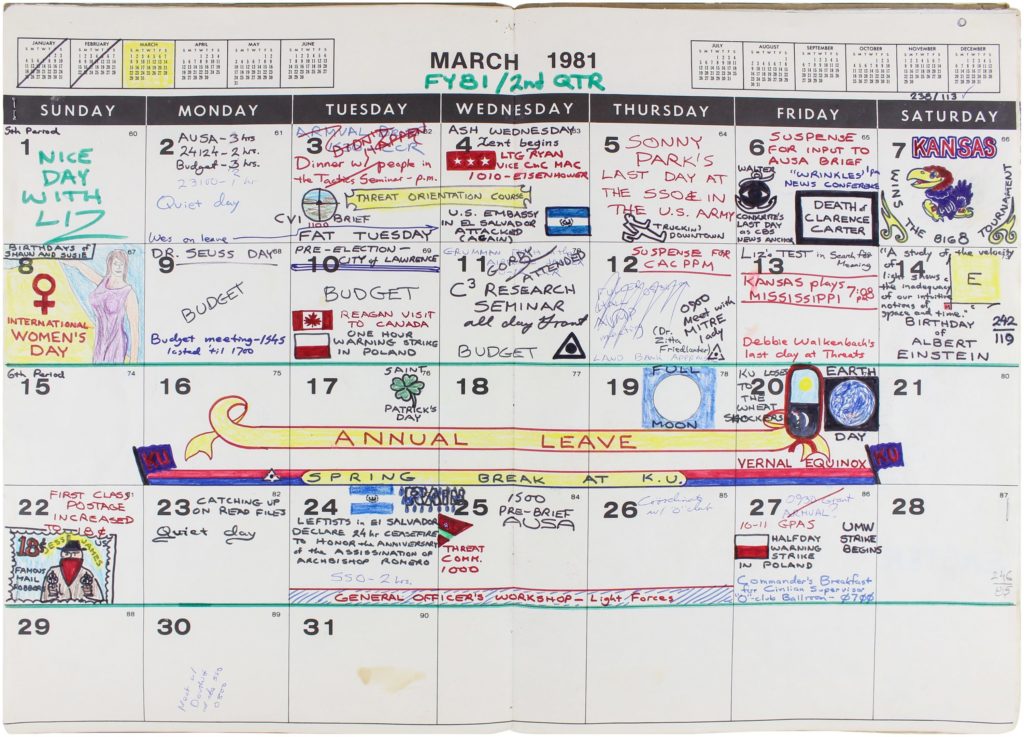

A Disgruntled Federal Employee’s 1980s Desk Calendar

接受PR>=1、BR>=1,流量相当,内容相关类链接。